The Milano Cortina 2026 Winter Olympics opening ceremony scheduled for February 6 at Milan’s iconic San Siro Stadium represents the culmination of Italy’s $4.5 billion infrastructure investment gamble that promises to showcase elite winter sports while risking the budget overruns and corruption scandals that plagued previous host nations from Sochi to Rio. The Italian organizing […]

Category: Economy

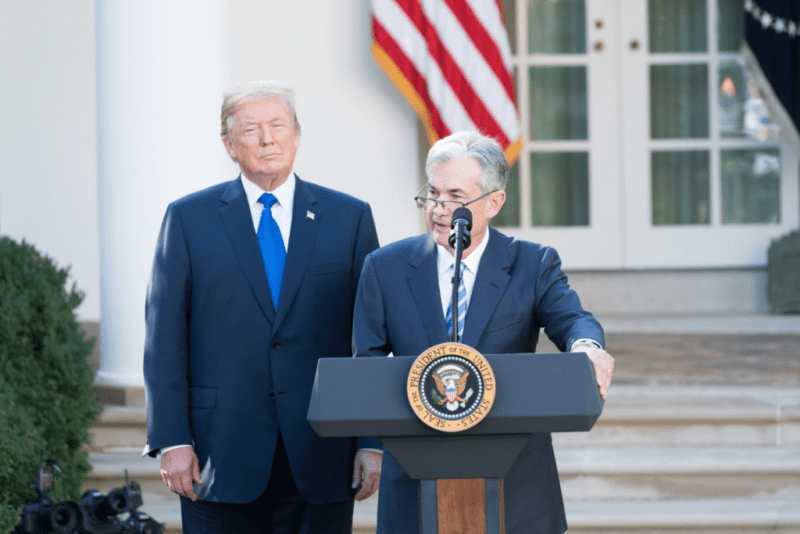

Trump names hawkish Kevin Warsh as Fed chair while mortgage rates creep higher as bond vigilantes wake from decade-long slumber

President Trump’s Thursday announcement nominating Kevin Warsh to replace Jerome Powell as Federal Reserve Chairman sent shockwaves through bond markets that had hoped for dovish replacement willing to cut rates aggressively despite persistent inflation, with the selection of a known monetary hawk who served on the Fed Board from 2006 to 2011 signaling that the administration recognizes […]

Healthcare stocks crater $400 billion as Trump guts Medicare while S&P 500 earnings beat 82% of estimates despite looming Fed showdown

United Healthcare Group plunged 19%, Humana cratered 20%, and CVS Health collapsed 10% on Tuesday January 27 as the Trump administration proposed nearly flat Medicare Advantage reimbursement rates that obliterated healthcare sector valuations and erased over $400 billion in market capitalization within hours. The brutal selloff demonstrated how single regulatory decisions from hostile administrations can […]

Inside India’s 77th Republic Day: How world’s largest democracy navigates authoritarian threats while Trump administration implodes democratic norms

India celebrated its 77th Republic Day on Sunday January 26, 2026, with the magnificent parade at Kartavya Path showcasing military might, cultural diversity, and constitutional governance at precisely the moment when American democracy faces unprecedented assault from an administration deploying troops against citizens and threatening economic warfare against allies. The choice of European Union leaders […]

Japan’s bond crash forces global yield spike as memory chip shortage drives Korean KOSPI above 5,000 while precious metals crater

Japanese government bonds suffered a spectacular selloff Tuesday January 21 following the Takaichi administration’s announcement of plans to reduce consumption tax on food and beverages for two years ahead of the February 8 lower house election, triggering a fiscal panic that sent ripples through global fixed income markets and demonstrated how political expediency can rapidly […]

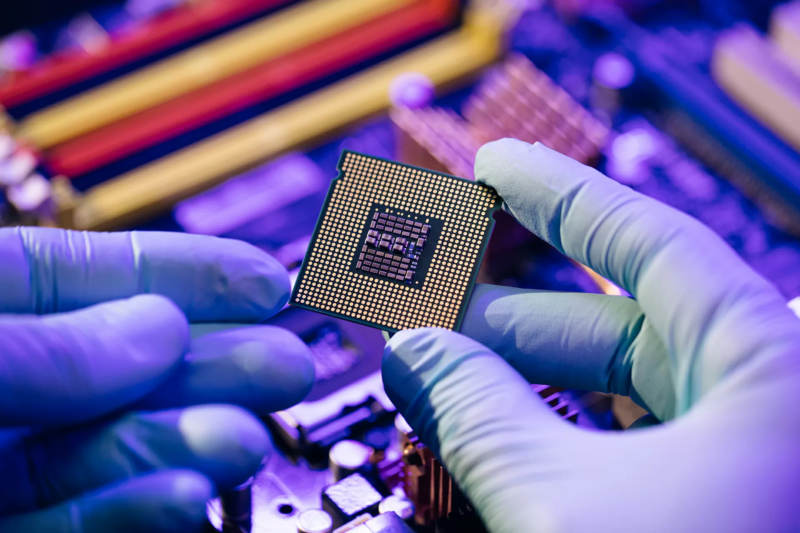

Taiwan Semi’s blowout forecast triggers $150 billion chip rally while rotation into small caps signals end of Magnificent Seven dominance

Taiwan Semiconductor Manufacturing Company delivered the catalyst that artificial intelligence bulls desperately needed on Wednesday January 15, with a blowout earnings forecast that sent the chipmaker’s stock soaring and triggered a $150 billion rally across semiconductor names while erasing concerns about sustainability of data center spending that had plagued the sector. TSMC’s results and optimistic […]

Trump’s $1.5 trillion defense spending bomb threatens bond markets as deficit explosion forces rethink of fixed income allocations

President Trump’s Wednesday announcement calling for U.S. military spending to surge to $1.5 trillion in 2027, up from the 2026 military budget set at $901 billion, sent shockwaves through bond markets that were already grappling with elevated yields and concerns about federal deficit sustainability. The proposed 66% spending increase in a single year would blow […]

Follow the Money: Iran’s missing $8 billion exposes regime’s final plunder as uprising threatens theocracy while oil revenues vanish into elite pockets

The nationwide uprising that erupted across Iran on December 28, 2025, entered its fifth consecutive day on January 2, 2026, fueled not just by political grievances but by a catastrophic economic collapse rooted in systematic corruption that has seen billions in oil revenues disappear while ordinary Iranians suffer under crushing inflation and currency freefall. Mohammad […]

Seven bold predictions for 2026 markets as valuation extremes, political uncertainty, and Fed policy create volatile environment

The extraordinary confluence of stretched equity valuations, upcoming midterm elections, geopolitical tensions, and uncertain Federal Reserve policy creates 2026 investment landscape characterized by elevated volatility and divergent outcomes across asset classes. Conservative investors planning for the coming year must navigate environment where traditional 60/40 portfolios face challenges from both expensive stocks and modest bond yields, […]

Why Treasury bonds deserve larger allocation as Fed pivot creates tailwinds for fixed income returns

The dramatic shift in Federal Reserve policy from aggressive tightening during 2023 to systematic rate cuts throughout 2025 creates compelling opportunity for conservative investors to increase fixed income allocations that have suffered devastating losses during the most aggressive monetary tightening campaign in four decades. Treasury bonds trading at 4.3% yields offer attractive risk-adjusted returns compared […]