Apple shares plummeted 8% in Friday trading despite reporting earnings and revenue that exceeded analyst estimates, demonstrating how elevated expectations and stretched valuations create conditions where even solid results trigger selloffs when specific metrics disappoint. The iPhone maker’s fiscal first quarter earnings of $2.84 per share beat the $2.67 consensus while $143.76 billion revenue surpassed […]

Category: Investing

Follow the Money: Treasury sanctions expose $7 billion Iranian oil embezzlement as regime massacres 3,900 protesters while elites funnel wealth through IRGC shell companies

The U.S. Treasury Department’s Friday January 30 sanctions targeting Iranian regime officials responsible for brutal protest crackdowns revealed extraordinary details about systematic corruption where billions in oil revenues get embezzled through Revolutionary Guard networks while security forces massacre thousands of citizens demanding accountability. Among those sanctioned was Babak Morteza Zanjani, a criminal Iranian investor who previously embezzled […]

Silver’s 30% Friday plunge erases $200 billion as Warsh nomination triggers historic commodity carnage while ETF launches hit record pace

Silver prices suffered the most catastrophic single-day collapse in modern precious metals history on Friday January 30, plummeting approximately 30% to $80.55 per ounce at session lows as investors fled commodities en masse following President Trump’s nomination of inflation hawk Kevin Warsh as Federal Reserve Chairman. The brutal selloff erased roughly $200 billion in market capitalization across […]

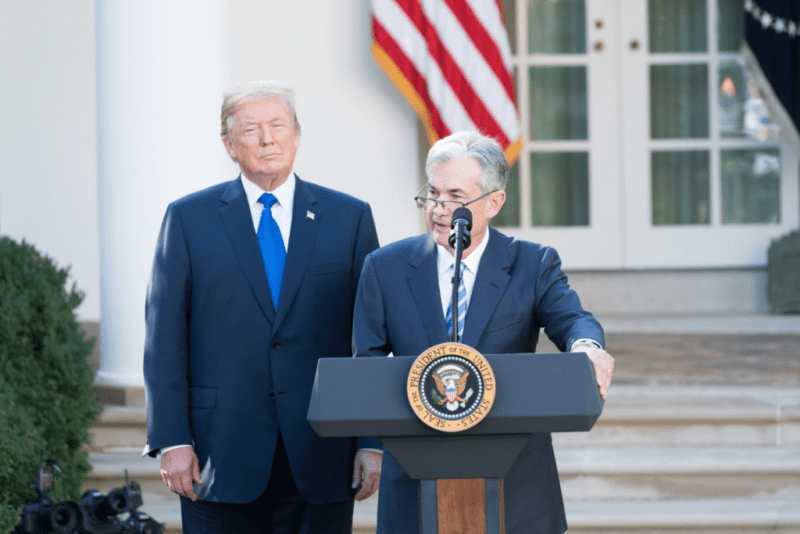

Trump names hawkish Kevin Warsh as Fed chair while mortgage rates creep higher as bond vigilantes wake from decade-long slumber

President Trump’s Thursday announcement nominating Kevin Warsh to replace Jerome Powell as Federal Reserve Chairman sent shockwaves through bond markets that had hoped for dovish replacement willing to cut rates aggressively despite persistent inflation, with the selection of a known monetary hawk who served on the Fed Board from 2006 to 2011 signaling that the administration recognizes […]

Healthcare stocks crater $400 billion as Trump guts Medicare while S&P 500 earnings beat 82% of estimates despite looming Fed showdown

United Healthcare Group plunged 19%, Humana cratered 20%, and CVS Health collapsed 10% on Tuesday January 27 as the Trump administration proposed nearly flat Medicare Advantage reimbursement rates that obliterated healthcare sector valuations and erased over $400 billion in market capitalization within hours. The brutal selloff demonstrated how single regulatory decisions from hostile administrations can […]

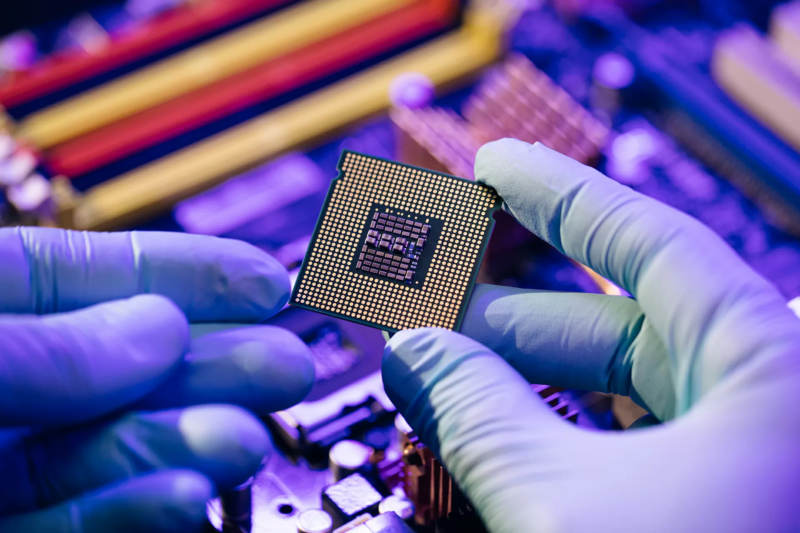

Taiwan Semi’s blowout forecast triggers $150 billion chip rally while rotation into small caps signals end of Magnificent Seven dominance

Taiwan Semiconductor Manufacturing Company delivered the catalyst that artificial intelligence bulls desperately needed on Wednesday January 15, with a blowout earnings forecast that sent the chipmaker’s stock soaring and triggered a $150 billion rally across semiconductor names while erasing concerns about sustainability of data center spending that had plagued the sector. TSMC’s results and optimistic […]

Markets closed New Year’s Day but 2026 setup screams commodity ETFs as China export ban and AI boom create silver squeeze Wall Street never saw coming

Financial markets remained shuttered on New Year’s Day as traders worldwide took the day off to recover from holiday celebrations, but the positioning and momentum built throughout 2025’s final trading sessions create compelling arguments for commodities exposure as 2026 begins. While U.S. equity markets do not operate on January 1 each year and there was no regular […]

Treasury yields close 2025 lower despite final-day spike as divided Fed creates bond market chaos that savvy investors can exploit

The final trading session of 2025 delivered a fitting conclusion to one of the most volatile years for bonds in recent memory, with Treasury yields reversing course Wednesday morning and climbing sharply higher after initial jobless claims data came in stronger than expected. The 10-year Treasury yield rose more than 3 basis points to finish […]

Silver shatters records with 169% annual surge while stock markets drift in holiday trading as geopolitical tensions reshape investment landscape

The return of Wall Street from the Christmas holiday on Friday, December 26, 2025, delivered a stark contrast between sleepy equity markets and explosive precious metals action that continued to rewrite record books. While the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closed marginally lower in thin holiday trading, commodities markets experienced […]

Seven bold predictions for 2026 markets as valuation extremes, political uncertainty, and Fed policy create volatile environment

The extraordinary confluence of stretched equity valuations, upcoming midterm elections, geopolitical tensions, and uncertain Federal Reserve policy creates 2026 investment landscape characterized by elevated volatility and divergent outcomes across asset classes. Conservative investors planning for the coming year must navigate environment where traditional 60/40 portfolios face challenges from both expensive stocks and modest bond yields, […]