Apple shares plummeted 8% in Friday trading despite reporting earnings and revenue that exceeded analyst estimates, demonstrating how elevated expectations and stretched valuations create conditions where even solid results trigger selloffs when specific metrics disappoint. The iPhone maker’s fiscal first quarter earnings of $2.84 per share beat the $2.67 consensus while $143.76 billion revenue surpassed […]

Category: Stocks

Healthcare stocks crater $400 billion as Trump guts Medicare while S&P 500 earnings beat 82% of estimates despite looming Fed showdown

United Healthcare Group plunged 19%, Humana cratered 20%, and CVS Health collapsed 10% on Tuesday January 27 as the Trump administration proposed nearly flat Medicare Advantage reimbursement rates that obliterated healthcare sector valuations and erased over $400 billion in market capitalization within hours. The brutal selloff demonstrated how single regulatory decisions from hostile administrations can […]

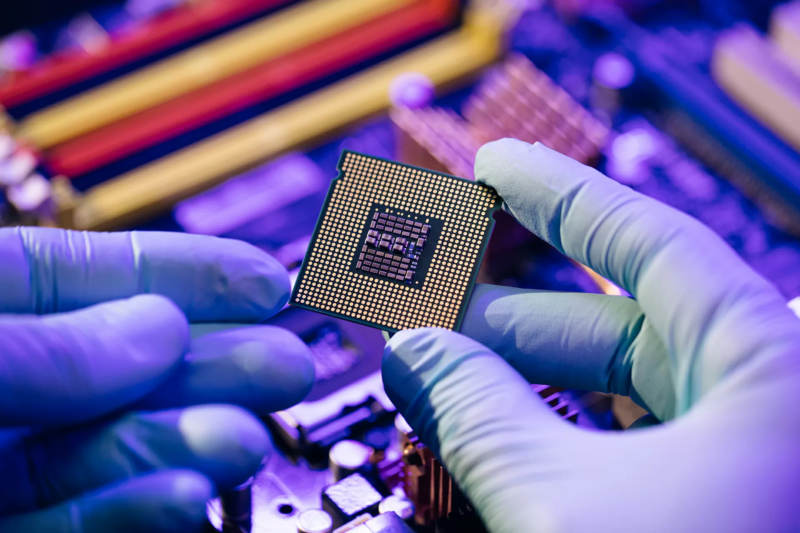

Taiwan Semi’s blowout forecast triggers $150 billion chip rally while rotation into small caps signals end of Magnificent Seven dominance

Taiwan Semiconductor Manufacturing Company delivered the catalyst that artificial intelligence bulls desperately needed on Wednesday January 15, with a blowout earnings forecast that sent the chipmaker’s stock soaring and triggered a $150 billion rally across semiconductor names while erasing concerns about sustainability of data center spending that had plagued the sector. TSMC’s results and optimistic […]

Markets closed New Year’s Day but 2026 setup screams commodity ETFs as China export ban and AI boom create silver squeeze Wall Street never saw coming

Financial markets remained shuttered on New Year’s Day as traders worldwide took the day off to recover from holiday celebrations, but the positioning and momentum built throughout 2025’s final trading sessions create compelling arguments for commodities exposure as 2026 begins. While U.S. equity markets do not operate on January 1 each year and there was no regular […]

Why small-cap value stocks offer 50% upside as Russell 2000 trades at steepest discount to large-caps in two decades

The extraordinary valuation disparity between mega-cap technology stocks trading at 35 times earnings and small-cap value companies averaging 12 times earnings has created the widest spread since the dotcom bubble peak, presenting conservative contrarian investors with generational opportunity to accumulate quality businesses at prices not seen since the 2008 financial crisis aftermath. The Russell 2000 […]

Why dividend aristocrats offer superior wealth preservation as market correction risks intensify heading into 2026

The S&P 500 Dividend Aristocrats index comprising 67 companies that have increased dividends for at least 25 consecutive years has outperformed the broader market during every major correction over the past four decades, validating conservative investment philosophy that prioritizes consistent cash distributions over speculative growth narratives. The current market environment where Bank of America’s bear […]

Final 8 days to slash 2025 taxes through harvesting losses, maximizing retirement contributions, and implementing charitable strategies

The final trading week of 2025 represents last opportunity for taxpayers to implement strategies reducing 2025 liability or deferring income into 2026 when potentially lower tax rates or changed personal circumstances could produce superior after-tax outcomes. Conservative tax planners emphasize that year-end deadline creates artificial urgency forcing decisions within compressed timeframe, yet the genuine tax […]

Why emerging markets offer 40% upside as valuations hit decade lows while U.S. stocks trade at dotcom-era extremes

The extraordinary valuation gap between U.S. equities trading at 23 times forward earnings and emerging market stocks averaging 11 times earnings has reached extremes not seen since the dotcom bubble peak in 2000. Conservative investors who maintained domestic-only allocations during America’s 15-year outperformance now confront compelling mathematical case for international diversification as mean reversion threatens […]

Five conservative options strategies to generate income and hedge downside as volatility creates opportunities

The violent market swings that characterized November and December have elevated the CBOE Volatility Index to levels not seen since spring’s tariff-induced selloff, creating lucrative opportunities for conservative investors to generate premium income through systematic options strategies. The convergence of stretched equity valuations, uncertain Federal Reserve policy, and technical deterioration suggests that elevated volatility will […]

Seven ETF strategies to protect wealth as Bank of America’s bear signals flash maximum danger

Bank of America’s December research note revealing that 60% of their proprietary bear market indicators are flashing red represents the clearest warning yet that the bull market that began in April’s tariff-induced lows faces imminent correction. Conservative investors who maintained aggressive equity allocations during 2025’s rally now confront urgent decision about whether to reduce risk […]